The Only Guide for Top 30 Forex Brokers

The Only Guide for Top 30 Forex Brokers

Blog Article

Unknown Facts About Top 30 Forex Brokers

Table of ContentsExcitement About Top 30 Forex BrokersAll About Top 30 Forex BrokersAn Unbiased View of Top 30 Forex BrokersAn Unbiased View of Top 30 Forex BrokersExamine This Report about Top 30 Forex BrokersThe 3-Minute Rule for Top 30 Forex BrokersNot known Incorrect Statements About Top 30 Forex Brokers

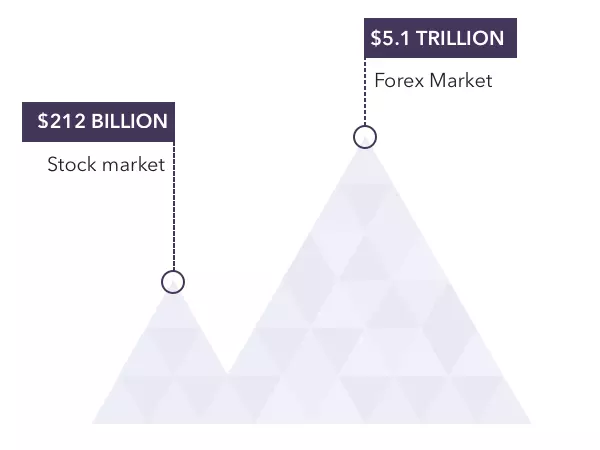

However, foreign exchange trading has its negative aspects, such as high threat and volatility. Foreign exchange is the largest and most liquid market on the planet. Trillions of dollars worth are traded everyday. A job as a foreign exchange investor can be rewarding, adaptable, and very interesting. There is a steep knowing curve and foreign exchange traders encounter high dangers, take advantage of, and volatility.

There are a number of advantages that a occupation as a forex investor, likewise known as a forex investor, offers. They consist of: Foreign exchange trading can have extremely inexpensive (brokerage firm and payments). There are no payments in a genuine sensemost foreign exchange brokers make revenues from the spreads between foreign exchange currencies. One does not have to stress over consisting of separate broker agent fees, eliminating overhanging expenses.

The Definitive Guide to Top 30 Forex Brokers

The forex markets run all day, enabling professions at one's ease, which is really useful to short-term investors who often tend to take placements over brief durations (say a few minutes to a few hours). Few traders make professions during full off-hours. Australia's daytime is the nighttime for the East Shore of the United state

business hoursOrganization as little development is advancement and prices are in a stable range during array off-hours for AUD. Such investors adopt high-volume, low-profit trading techniques, as they have little profit margins because of an absence of advancements certain to foreign exchange markets. Rather, they try to make revenues on fairly stable reduced volatility duration and make up with high quantity trades.

Foreign exchange trading is very fitting in this means. Contrasted with any other economic market, the forex market has the largest notional value of everyday trading. This supplies the highest degree of liquidity, which indicates also huge orders of money professions are quickly loaded successfully without any kind of huge cost variances. This gets rid of the possibility of price control and price anomalies, thereby enabling tighter spreads that bring about much more effective pricing.

Unless significant events are anticipated, one can observe similar cost patterns (of high, mid, or low volatility) throughout the continuous trading.

The Top 30 Forex Brokers PDFs

Such a decentralized and (reasonably) deregulated market aids avoid any type of sudden surprises. Tickmill. Orders are straight put with the broker that executes them on their very own.

The major currencies regularly present high price swings. If trades are placed intelligently, high volatility helps in huge profit-making possibilities. There are 28 major money sets involving eight significant currencies. Criteria for selecting a set can be convenient timing, volatility patterns, or financial developments. A foreign exchange trader that enjoys volatility can quickly switch over from one money set to another.

See This Report on Top 30 Forex Brokers

Without even more funding, it may not be possible to trade in other markets (like equity, futures, or choices). Accessibility of margin trading with a high leverage variable (up to 50-to-1) comes as the topping on the cake for forex professions. While trading on such high margins comes with its own dangers, it also makes it much easier to improve revenue potential with limited funding.

It is still often subject to market control. In essence, there are lots of benefits to forex trading as a profession, yet there are downsides.

The Ultimate Guide To Top 30 Forex Brokers

Being broker-driven ways that the foreign exchange market may not be completely clear. A trader might not have any control over just how his profession order gets met, might not obtain the finest cost, or may obtain restricted sights on trading quotes as provided only by his picked broker. A straightforward service is to deal only with managed brokers that fall within the purview of broker regulators.

Foreign exchange rates are influenced by several aspects, mainly international politics or economics that can be challenging to assess details and draw trusted final thoughts to trade on. A lot of forex trading happens on technical indications, which is the primary reason for the high volatility in foreign exchange markets. Getting the technicals wrong will certainly lead to a loss.

Examine This Report about Top 30 Forex Brokers

Forex traders are entirely on their very own with little or no help. Disciplined and continual self-directed discovering is a need to throughout the trading occupation. Many novices give up during the first phase, largely due to losses suffered due to limited forex trading expertise and improper trading. Without any control over macroeconomic and geopolitical developments, one can conveniently endure huge losses in the extremely volatile forex market.

Report this page